The next step needs information about the outstanding shares and the current market price of the security let's say:Īssume the current share value of the Alpha company is 5 USD / share. Net outstanding debt = 800,000 USD, then:

#Dcf calculator free

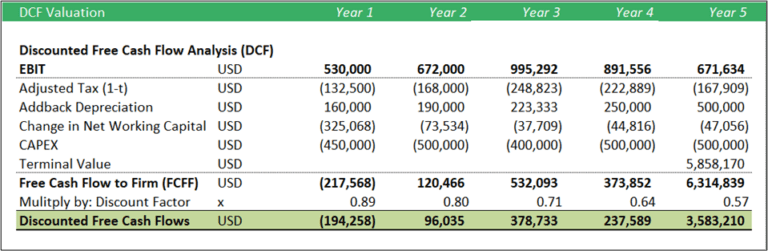

Let's assume Company Alpha which has the following expected free cash flow to the firm:Īfter we bring all the cash flows back to the present, we getĪs mentioned above, we need to discount the net outstanding debt.

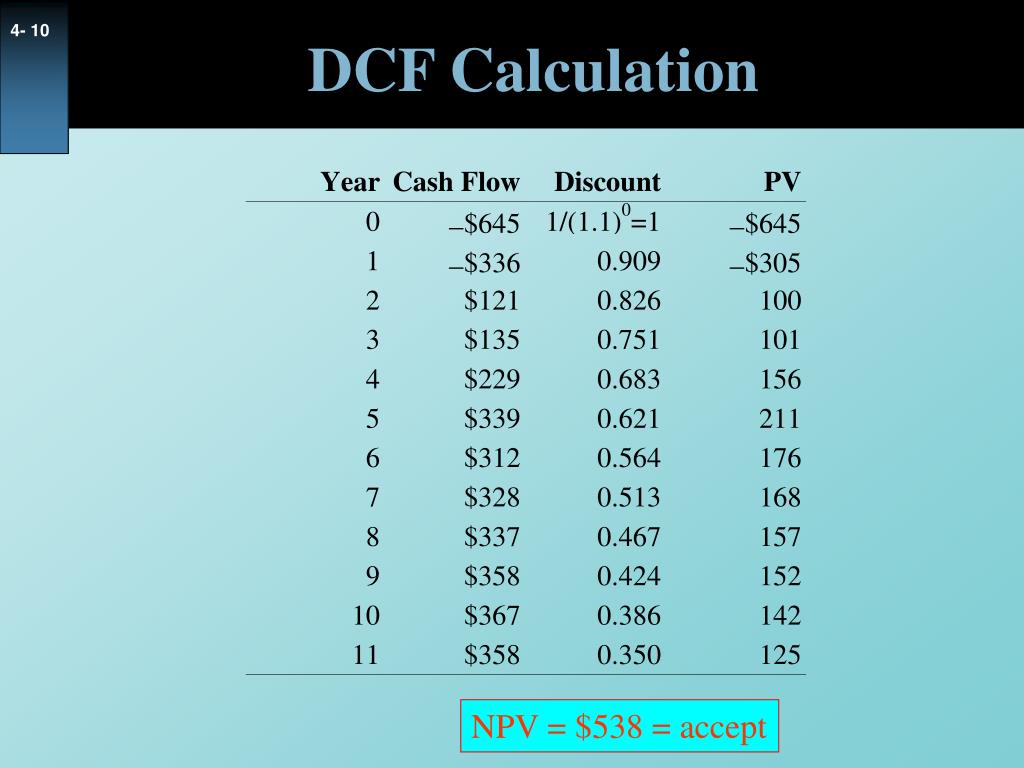

In this section, we will perform an analysis of a company using the discounted cash flow valuation method. Remember that if we were to use free cash flow to equity (FCFE) ( FCFE calculator), we would need to discount the FCFE by the cost of equity. Since we are using free cash flow to the firm, the discount rate has to be the weighted average cost of capital (WACC) because this discount rate includes the effect of both sources of funding for a company: equity + creditors. The NPV uses a discount rate, as mentioned above. Note that this formula is the sum of all the FCFF in the future but brought to the present by the net present value (NPV). Consequently, we obtain the firm's present value when we apply the DCF formula. The FCFF considers all the money available to the owners and creditors. Note that the DCF result, the sum, can be infinite however, that's not realistic because no company will exist forever thus, we have to choose an appropriate t t t according to certain guidelines explained below. R r r – Discount rate needed to value such future cash flows in the present. T t t – Time associated with the future expected cash flows we are going to consider in our analysis and In this DCF calculator, we will show you both methods.į C F F \rm FCFF FCFF – Free cash flow to the firm and represents the future expected cash flows of the company Some analysts prefer to use earnings per share to project future cash flows because they are the net earnings to the shareholders. To facilitate that, we use the concept of the net present value, which considers a discount rate. Then these future cash flows have to be valued in the present. The expected future cash flows are projected up to the company's life. We have to value the business's future cash flows, which represent the return, and see if what we are going to pay for the company in the present makes it a sound investment.Īnd that's the strategy of the discounted cash flow approach.

The same approach can be used when new investors want to buy shares of the business or, on a bigger scale, when a company wants to acquire another one: So, cash flows are valuable and represent the return on the investment shareholders/owners made when they started the company.

Such cash flows can be in the form of dividends, for example. Let's think about it for a second: what is the value of a company to its owners? As mentioned in the free cash flow calculator, owners expect to receive cash flows from the company. The discounted cash flow model is an income valuation method that determines the fair value of a company or stock by analyzing the future expected cash flows and defining how much they value in the present.

0 kommentar(er)

0 kommentar(er)